The Free Application for Federal Student Aid (FAFSA) announced another delay in its release for the 2024–25 school year until early March. Here’s what you need to know.

What Students Can Do

Even through the unpredictability of the FAFSA’s (lack of) availability, College and Career Center Counselor Laura Duran advised students to keep applying for financial aid. Here is what students are recommended to do:

- Students should apply for FAFSA through this form.

- Or, the California Dream Act

- Or fill out the MVLA Opt-out Form

“If students haven’t started financial aid, they should, because it’s not too late and they’re not behind,” Duran said. “There are eight states right now that have a financial aid requirement because billions of dollars were going unclaimed.”

Duran recommended that students at least submit the FAFSA form, so that it is transferred into the pending stage where students are currently waiting at. The best thing to do is to get [the application] pending to the point where it gets stuck. And once there’s a fix, we’re gonna share it.”

- Students should apply for the College Scholarship Service profile through this form.

“Some colleges have said that they will honor the CSS profile estimates that are given [over the FAFSA],” Duran said. “So if there’s a change to FAFSA which shows that you should be given less money, some colleges will honor what [the CSS profile] tells students, and if there’s a change after they get their FAFSA, [the college] won’t go down.”

- Students should apply for scholarships.

“[Scholarships are] something that you can actually do right now. You can stress, but it’s not gonna get you more money,” Duran said.

A Year of Changes and Delays

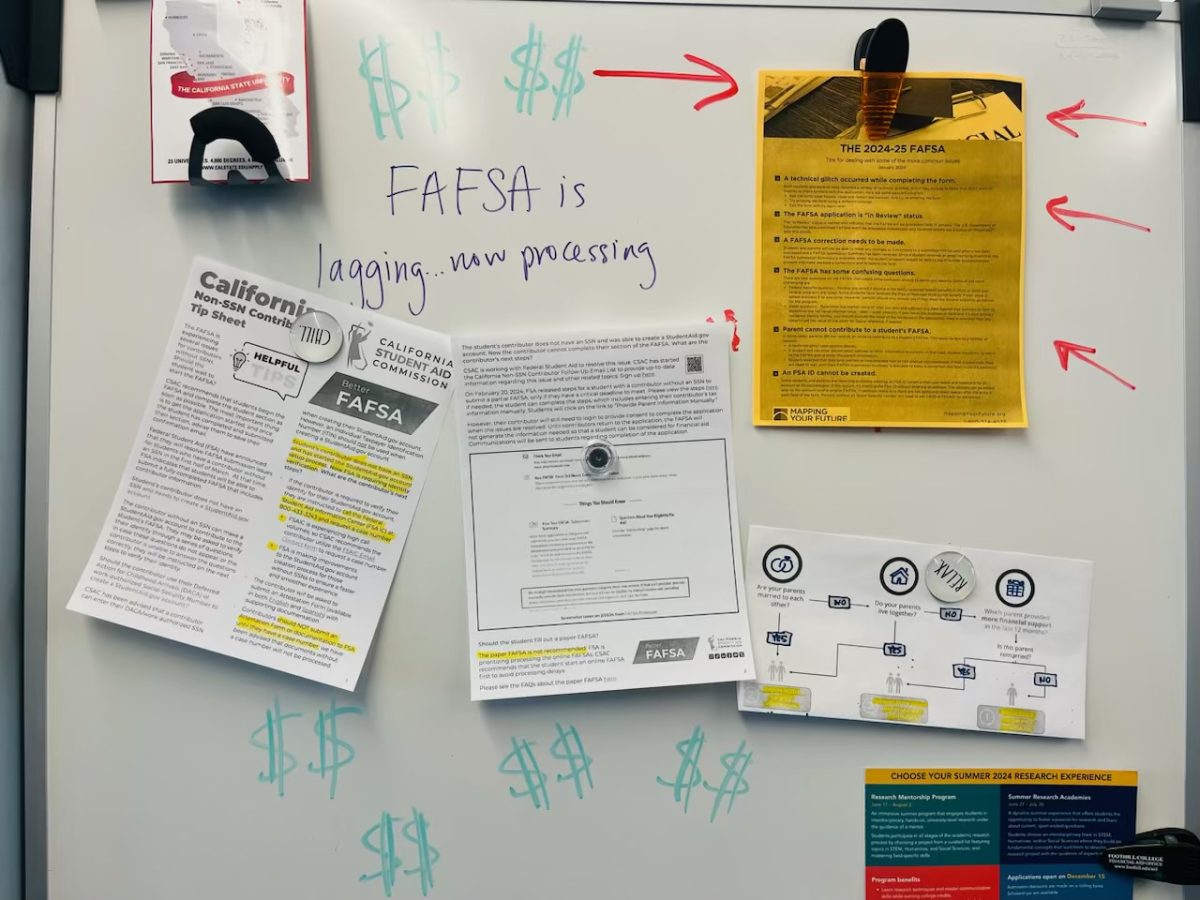

Prior to the form’s release last summer, FAFSA announced changes to their form from previous years. Some of the most significant changes that were made to the form are as follows:

- All providers of information on your FAFSA form will be considered “contributors.”

- All contributors must consent and approve to allow the Internal Revenue Service to release the applicant’s tax information directly to FAFSA. Otherwise, you will not be eligible to receive federal financial aid.

- All contributors must make a StudentAid.gov account in order to access the FAFSA form.

- The Student Aid Index (SAI) replaces the Expected Family Contribution section of the form, calculating an index number based on information provided by contributors.

- More students can qualify for the Federal Pell Grant funds.

- The FAFSA Submission Summary replaces the Student Aid Report.

These changes were a result of the FAFSA Simplification Act, passed in 2020 by the United States Congress, in an effort to streamline the financial aid process for students and families submitting the FAFSA form.

However, applicants for the next 2024-25 school year were unable to access the form due to the first of many delays announced by FAFSA; instead of its originally projected release date of October 1, 2023, students only gained access to the form starting on December 31.

While FAFSA had promised that colleges would be receiving students’ financial data in late January, they announced an additional delay, saying that the information would be released in early March.

Why this is happening

Duran explained that despite the form’s delayed release, FAFSA is continuing to work through internal issues.

“Once the form was released in January, there was an error with the inflation matrix,” Duran said. “Congress had said that you specifically have to include inflation so that families are getting a more accurate amount, but they left out that line of the algorithm.”

Duran explained that FAFSA’s lack of time had not allowed them to test the form prior to its release, leaving students to deal with “pending changes.” Although FAFSA had initially considered continuing with the incorrect form, they ultimately decided to fix the errors, contributing to the further delay.

Another significant issue within the form that Duran pointed to was for U.S. citizen applicants whose guardians were undocumented.

“They literally cannot complete the form,” Duran said. “There’s nothing that they can do to complete the form. Congress knows it’s an issue, the Department of Education knows it’s an issue, colleges know it’s an issue — everyone knows it’s an issue.”

“There’s a lot of families that are trying and hitting these errors, and they don’t know it’s a [common] issue; so it’s a lot of stress and anxiety when they come to us,” Duran said. “There is no solution as of today.”

Effects of delayed FAFSA (What to expect)

Since many schools such as the University of California and California State Universities have extended their commitment deadlines from May 1–May 15, Duran predicted that colleges and universities will experience a delay in releasing waitlist offers to students.

“How colleges plan for housing, how they plan their courses and admitted student day will all look different,” Duran said. “If they don’t hit their enrollment numbers, that changes staffing; that changes everything.”

Furthermore, Duran explained that colleges and universities are responding differently to the abrupt delays and changes made by FAFSA, starting by extending the deadline for financial aid information submission from students.

Students should be on the lookout for colleges such as Chapman University, Wheaton College and other schools that have offered their own financial aid estimates due to the extensions of financial aid deadlines.

Keep Persevering

To many students and families, the FAFSA delays have understandably caused anxiety and confusion. For the Class of 2024, it’s just another hurdle in a unique high school experience riddled with unexpected challenges. Still, though, amidst such unclear circumstances, Duran encourages students to keep finding their strength.

“You all started virtual and unfortunately we’re calling on you again to sit in this brand new situation,” Duran said. “Continue to show that resilience.”